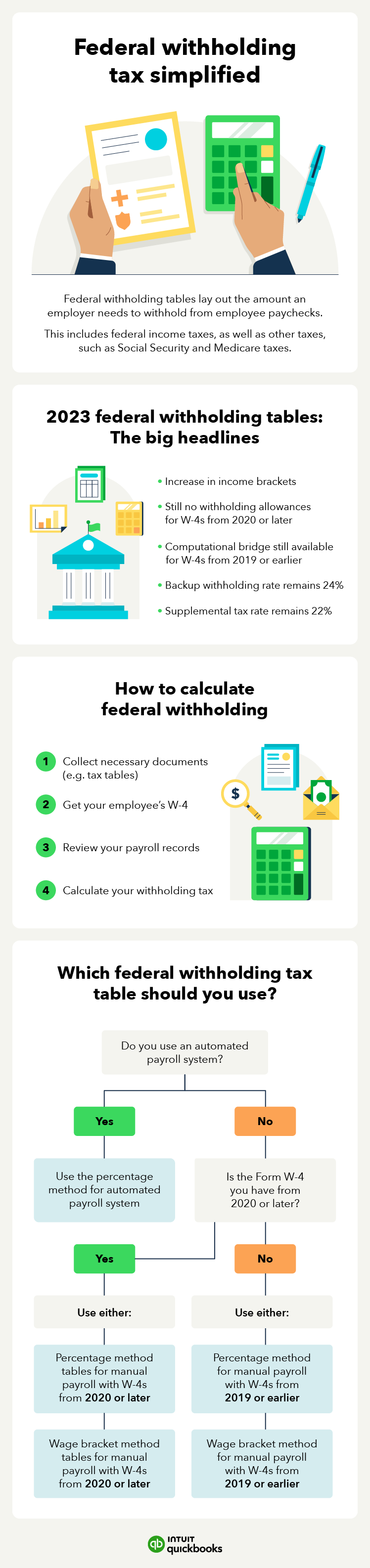

W4 Withholding Tables 2024 – The W-4 form is an Employee’s Withholding Allowance Certificate designed to let your employer know how much of your income to withhold for federal taxes. You should fill out a new W-4 when you have . Tax brackets are the government’s way of ensuring that taxpayers who earn more money pay more in taxes. Each bracket consists of a tax rate that’s applied to taxable income within a specific range. .

W4 Withholding Tables 2024

Source : www.patriotsoftware.comHere’s How to Fill Out the 2024 W 4 Form | Gusto

Source : gusto.comPowerChurch Software Church Management Software for Today’s

Source : www.powerchurch.com2024 Publication 15 T

Source : www.irs.govHow To Calculate Your Federal Taxes By Hand · PaycheckCity

Source : www.paycheckcity.comUpdated Income Tax Withholding Tables for 2024: A Guide

Source : www.patriotsoftware.comPublication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.govFederal Withholding Tax Tables: 2024 Guide | QuickBooks

Source : quickbooks.intuit.comProjected 2024 Income Tax Brackets CPA Practice Advisor

Source : www.cpapracticeadvisor.comEmployee’s Withholding Certificate

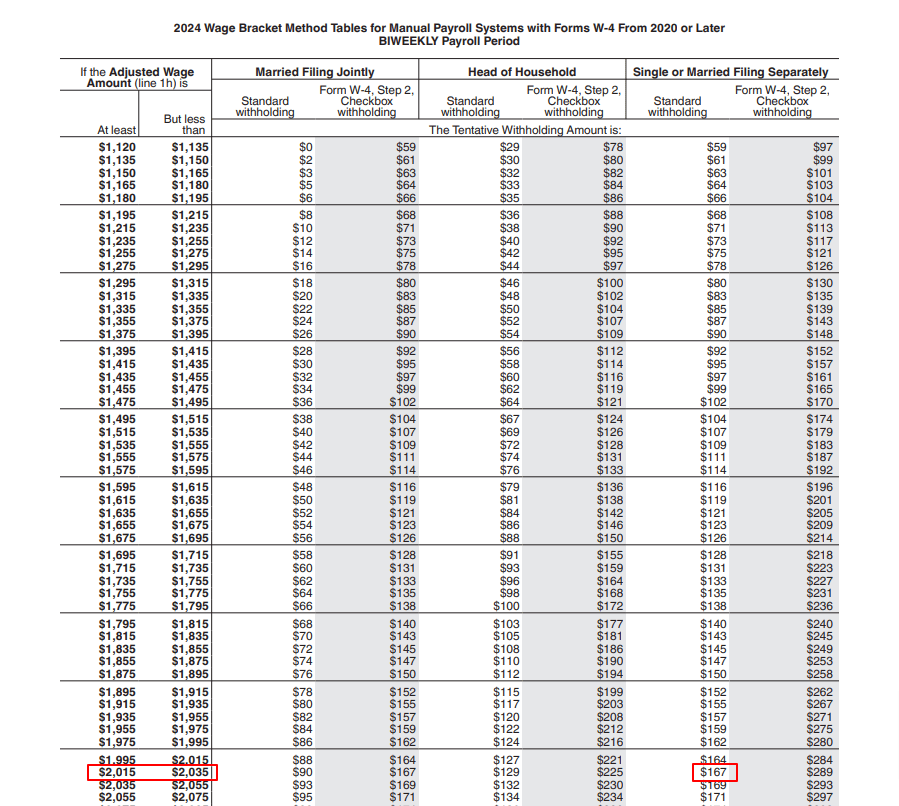

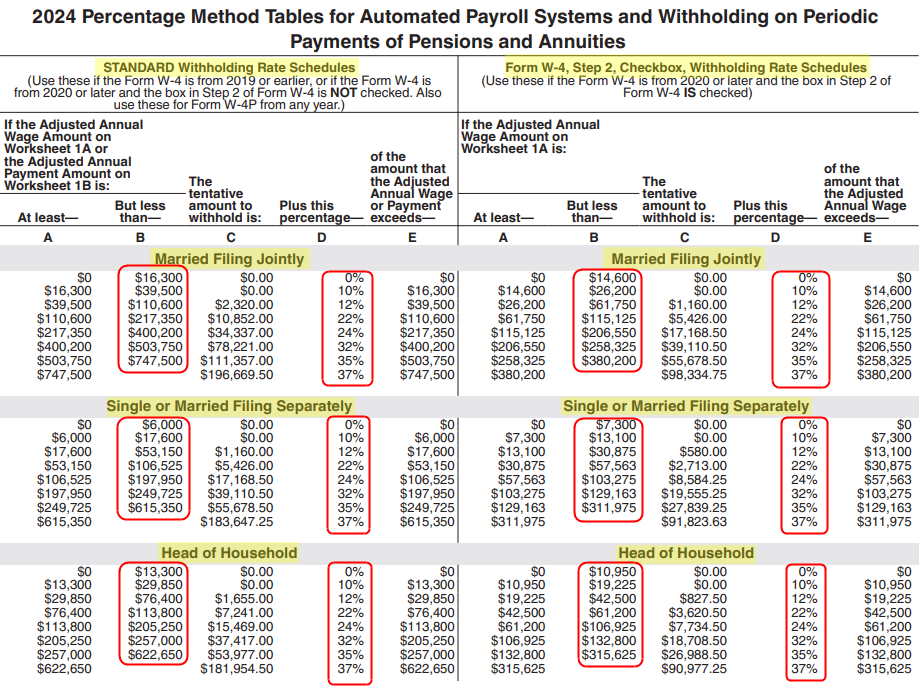

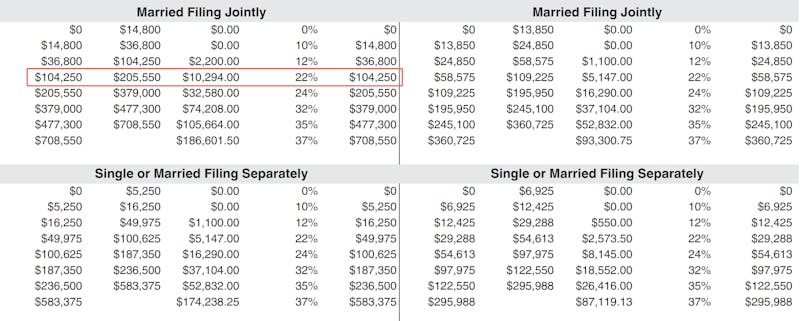

Source : www.irs.govW4 Withholding Tables 2024 Updated Income Tax Withholding Tables for 2024: A Guide: Publication 15-T provides worksheets and tables to figure federal income tax withholding for Forms W-4 from 2019 or earlier and Forms W-4 from 2020 or later. Starting in 2020, the formulas and tables . Don’t be alarmed, on average US tax refunds are 13% lower this year. Here are ways you can receive a bigger one. Peter is a writer and editor for the CNET How-To team. He has been covering .

]]>